So Far, So Good?-A Guest Post from Llenrock Group

Jun 30, 2014

This post from Eric Hawthorn is part of our Llenrock Group guest post series and originally appeared on the Llenrock Group blog.

A couple years ago, in a post entitled “A Return to Luxury,” I reported that UBS was offering single-asset CMBS on the famous Fontainebleau Hotel in Miami Beach. This was a significant move for the bank, and for the commercial real estate world, because it was the first time in over 10 years that a hotel property had been securitized as a single asset (rather than being packaged in a conduit with a variety of other assets and asset types). I brought up the the Fontainebleau at the time because it offered a positive sign for CMBS demand, not to mention investor confidence in the expensive, often-risky niche of luxury hotel properties.

This offering took place over two years ago and the CMBS market has recovered significantly since then. But I bring it up because the fact that UBS was able to execute an offering for a single hospitality asset says a lot, both about the quality of the asset and the recovery of the CMBS/CRE sectors since the mortgage-backed securities market took a nosedive in 2008-2009.

Of course, CMBS activity has picked up significantly since 2012, as has the hospitality/lodging sector, so it’s clear that investor demand hasn’t subsided for CMBS backed by hotel assets.

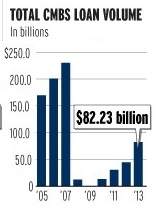

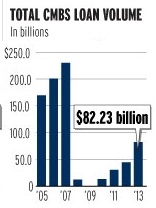

Take a look at the graph to the right. Obviously, CMBS issuance includes a variety of asset types, not simply hotel properties, but we know from examples like the Fountainebleau that hotels are a big part of America’s overall CMBS story. While 2013′s $82.33 billion is impressive, it pales in comparison to the highs reached during what one commentator dubbed “the euphoria of 2005-2007.” Still, it shows steady, substantial improvement from the trough of 2008-2009. In fact, analysts predict that 2014 may be the year we top $100 billion in CMBS issuance nationally, and judging by the rate we’re going so far this year, these analysts might be right.

Take a look at the graph to the right. Obviously, CMBS issuance includes a variety of asset types, not simply hotel properties, but we know from examples like the Fountainebleau that hotels are a big part of America’s overall CMBS story. While 2013′s $82.33 billion is impressive, it pales in comparison to the highs reached during what one commentator dubbed “the euphoria of 2005-2007.” Still, it shows steady, substantial improvement from the trough of 2008-2009. In fact, analysts predict that 2014 may be the year we top $100 billion in CMBS issuance nationally, and judging by the rate we’re going so far this year, these analysts might be right.

Amid rising occupancies, rents and property values, more bond investors are willing to buy CMBS debt, and the Wall Street banks that make the loans and put together CMBS offerings are more than happy to satisfy the increase in demand. Nationally, CMBS lending rose 85 percent last year, to $82.23 billion, according to Trepp.

Of course, some analysts are concerned that the U.S. CRE industry is returning to that magical thinking that led up to the real estate bubble and financial crisis in the first place. It wouldn’t be the first time the business world lapsed into a position of selective memory when it comes to certain financial practices.

Fitch Ratings has been outspoken about potential weaknesses in CMBS underwriting practices, the quality of the properties backing this debt, and quantities of outstanding debt. GlobeSt.’s Paul Bubny reports,

A little more than a year ago, Fitch Ratings expressed concern over the quality of the underwriting in many of the sizable securitizations that were being announced….

This year, …Fitch [has] a new worry. Although the quality of the properties has improved, the absolute level of debt on large loans issued this year pose the risk now.

Specifically, the ratings agency is concerned that ratings of ‘BBB−sf’ through ‘Bsf’ on a substantial number of 2014 large loan transactions are not warranted given the significant amount of debt at those ratings. In a new report, Fitch says that its wariness is “further reinforced by the amounts of additional debt, subordinate to the first mortgage, that raise leverage on the property and sponsor even further.”

As an example of this potential issue, Fitch points to the CMBS offering WFCM Trust 2014-TISH, which includes the hotel assets Westin Times Square and Sheraton Chicago. While both are extremely well-positioned lodging assets in core markets, their operating performance is threatened by a pipeline of new hotel supply in their markets, as well as tranches of non-securitized debt that may have received a lower grade by Fitch had they been rated.

Personally, I think that only severe mismanagement on the part of their operators would leave the aforementioned hotels in distress, so I’m not concerned about these assets in particular. However, the question of absolute debt is an important one, and one that CMBS borrowers, lenders, and investors would be wise to consider. Even if the market is steadily improving, strong fundamentals are no replacement for thorough due diligence. The quality of a property’s capital flows is only one consideration; if the property’s overall debt structure is flawed, the underwriter should know–and respond accordingly.

Posted by: Raymond T. Cirz